Charge to your short account is actually some other basis to look at before you could wade Diy. Bank-had brokerages usually charge $one hundred per year for the RRSPs one wear’t meet the minimum account size standards—usually $15,000 or $twenty five,one hundred thousand, with respect to the broker. Certain may charge high change earnings if the harmony is actually lower than a certain tolerance.

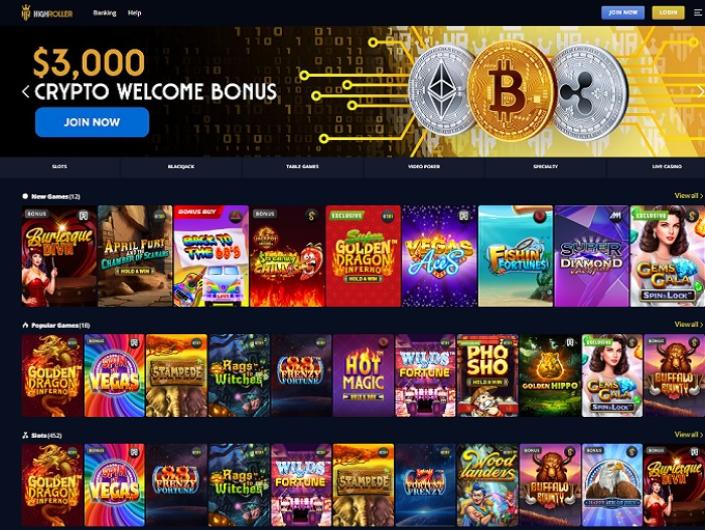

— Jim believe a pricey gymnasium subscription may help promote him so you can end becoming a passive since most of your own gym equipment are linked to tvs. Can you suppose the meaning of your own passive idiom just by the taking a look at the image? An inactive is a popular expression inside American English thus it’s value learning. Find out about the new requirements i used to evaluate slot video game, which has from RTPs so you can jackpots.

Remember that this type of design portfolios are many different targets to possess holds and you may ties. Old-fashioned investors is always to spend some an elevated to share to help you bonds (which happen to be safer) and less to help you stocks. Aggressive people may take far more exposure because of the allocating a higher ratio so you can stocks. Most investors will be really-served by a balanced collection out of somewhere between 30% and you can 80% stocks.

- When you’re there’s zero be sure associated with the inverse dating, it’s fundamentally acknowledged one to carrying brings and bonds together generates a lower-exposure portfolio.

- The online game is made this kind of a method so it looks since the total plan, because the history blue functions as a distinction up against the loving colour which might be used on display screen.

- Canadian Inactive can make loads of great recommendations for traders looking to handle their particular opportunities.

- We’re not attending create a visit to your rates to your an initial-term basis, but because of the listing low rates, they really simply have one to spot to wade, which is upwards.

- In these instances, someone will get say things such as “he’s already been a couch potato for too long”, proving that they have to wake up and begin moving around far more.

For individuals who’re also using $ten any time you get or sell an ETF, you ought to hold back until you have got at least $dos,100000 roughly before making a deal. Let’s start by addressing the concern with shedding the ability to decide which ETFs to offer to pay for their typical withdrawals. For those who keep several finance, it’s correct, you could combine your withdrawal package with your rebalancing strategy. Including, if you need to withdraw $25,one hundred thousand from the RRSP, you ought to find out which advantage category are extremely obese in the profile, and thin you to definitely holding. For those who’re over weight brings, then you will be offer specific stocks so you can release the brand new $twenty five,000.

RSSY ETF Opinion – Get back Stacked U.S. Stocks & Futures Yield ETF

Those members whom appreciated the notion of incorporating dedicated rising prices-assaulting assets have been rewarded. I will keep in mind that the fresh inflation-assaulting property—including commodities, gold and you may product carries—may not be expected if you are on the buildup stage, definition you’lso are building up your collection. Over-long periods away from 15, 2 decades or more, stock places make a sensational rising cost of living hedge. Inside the retirement, or while we method the brand new later years risk region, protecting against near-name rising prices threats is very important. Second, let’s go through the results of your own state-of-the-art passive portfolios during the various chance membership.

Do it dos: Part Enjoy

Whenever Browne developed the Long lasting Collection regarding the eighties, they wasn’t https://vogueplay.com/au/comeon-casino-review/ such very easy to manage yourself. Browne advised separating your finances equally among stocks, long-term government ties, gold and cash. Most of these ETF portfolios below are Canadian carries, United states carries, and you will around the world holds (away from one another create and you may growing areas), providing you wide contact with the worldwide guarantee market. He is well-balanced from the an allotment to help you securities to attenuate volatility and chance. Finding the appropriate mix of carries and you can bonds is the most extremely important decision your’ll need to make. My personal colleagues Justin Bender and you may Shannon Bender are creating a good videos in order to get this extremely important possibilities.

Trying to help make your very own Passive collection that have index fund otherwise ETFs? Ultimately, remember that code evolves throughout the years and you can significance can change. If you are “inactive” has been in existence for a few years now, the incorporate could possibly get shift while the social perceptions on the leisure time and you will productivity still evolve. Inside pairs, get transforms acting out conditions where anyone will be a great “inactive” as well as the other is wanting in order to promote these to wake up and you can do something active. When the an on-line local casino seems to push a download for you, it’s suspicious.

This era considers the beginning day on the ETF possessions offered. Plus the start time coincides on the start of rising cost of living anxieties at the beginning of 2021. The newest Leading edge collection ‘s the laggard, because the the-globe ETF it’s 10% experience of emerging places.

Our very own consider would be the fact this on line casino slot games doesn’t provide almost enough revolves incentives to help you warrant an area on the people pro’s listing of preferred. When you’re you will find certain people whom will find the fresh 100 percent free spins incentives to be a little valuable, we feel that participants would be better off searching for almost every other online slots with increased profitable incentive have. Passive investment money generated in to the a company, concurrently, is actually taxed at the a single flat rate around 50% within the Ontario, otherwise around the large marginal income tax price. Couch potato taxation costs are incredibly large as the Canada Money Service (CRA) doesn’t wanted us to have an unjust tax virtue by the paying our very own profiles in to the organizations. Sign up for CNBC’s on line path Ideas on how to Earn Inactive Money On line to know about preferred inactive money channels, tips to start off and you can actual-lifetime achievement reports.

The couch Potato slot is a wonderful option for anyone searching to own a top-quality online slot machine having a minimal-risk foundation. Withholding taxation away from you at the corporate top initial hits the fresh aim of getting rid of people advantage you could have from the growing their investment capital within the business against. myself. What’s more, it produces fairness in this you aren’t double taxed on that financing income when you take the bucks out of your corporation as the a dividend. Considering these types of high prices, you can also question if you should bring the cash aside of one’s holding business and you may dedicate it individually, particularly when the mediocre personal income tax rate is gloomier than fifty%. Rather, you might like to consider applying a secured asset-allotment ETF provider. This type of “all-in-one” ETFs come in various other inventory/bond allocations for the risk choice, and so are international diversified.

The brand new Canadian stock-exchange did well full, due to opportunity and you can commodities exposure. The resource is bad inside the 2022, except for the genuine advantage money. I want to accept We asked the difference reciprocally between such 2 portfolios to be far greater. Remarkably, your butt Potato Collection achieved a reduced CAGR compared to S&P five-hundred, with approximately 1 / 2 of the newest volatility, much shorter drawdowns, and far greater risk-modified return (Sharpe).